Please review the detailed coverage description, below, for additional information on Protector coverage, benefits, limitations and exclusions.

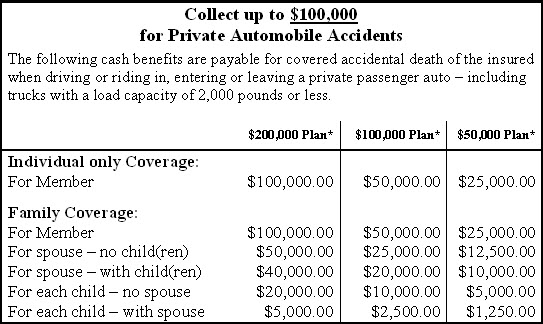

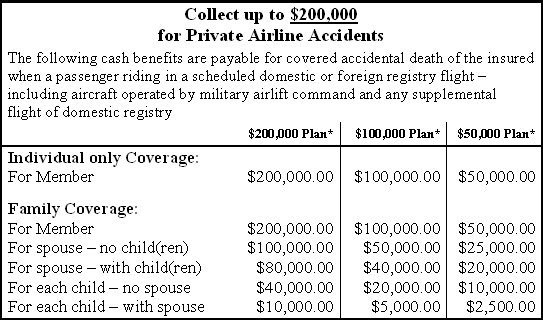

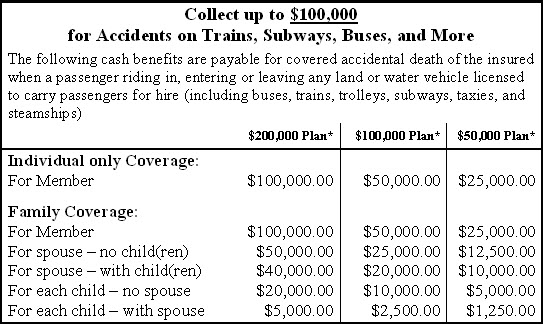

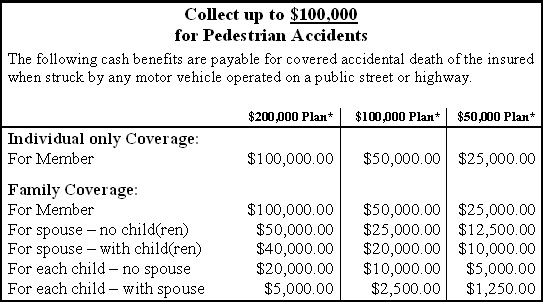

* 100% of the cash benefits listed will be paid for airline and common carrier accidents regardless of age. Cash benefits for automobile and pedestrian accidents are reduced 50% for insureds at age 75, and 75% for insureds age 80 and older.

COVERAGE WHEN FLYING:

Please review the detailed coverage description, below, for additional information on Protector coverage, benefits, limitations and exclusions.

COVERAGE ON COMMON CARRIERS:

Please review the detailed coverage description, below, for additional information on Protector coverage, benefits, limitations and exclusions.

COVERAGE WHEN CROSSING THE STREET:

Please review the detailed coverage description, below, for additional information on Protector coverage, benefits, limitations and exclusions.

* 100% of the cash benefits listed will be paid for airline and common carrier accidents regardless of age. Cash benefits for automobile and pedestrian accidents are reduced 50% for insureds at age 75, and 75% for insureds age 80 and older.

PROTECTOR LIMITS & EXCLUSIONS:

Benefits will not be payable if death, dismemberment or bodily injury to you or a Covered Dependent is caused by any of the following:

- Suicide or self-destruction or an attempt thereat while sane or insane;

- Participation in a riot, a declared or undeclared war or any maneuvers or training exercise of an armed service;

- Commission of, or attempting to commit any crime;

- The voluntary taking of any drug or acting under the influence or effect of that drug (unless prescribed or administered by a Doctor and taken in accordance with given instructions);

- Disease, bodily infirmity or sickness of any kind, unless a direct result of an accidental injury;

- Losses which are the result of an accident that occurred while an Insured is operating a land motor vehicle or is a pedestrian and has a blood alcohol level of .08 percent weight per volume or higher.

Coverage is provided to you, the Insured, and any Covered Dependents, subject to all the exclusions and provisions of the Group Policy. This Certificate is a description of the coverage provided under the Group Policy. In this Certificate, the "Insured" may be referred to as "you", "your", or "yours" and the insured family members may be referred to as "Covered Dependents", "Insured" or "Insureds". The Company will be referred to as "we", "our" or "us."

Individual Coverage: You are covered under the Group Policy.

Family Coverage: You and your Covered Dependents are covered under the Group Policy.

Covered Dependents include:

- "Dependent Spouse": Your legal spouse, unless already insured under the Group Policy as an Insured Member, and

- (b) "Dependent Children": Your unmarried, dependent children, unless they are already insured under the Group Policy as Covered Dependents. Dependent Children include (I) children under age 19 (23 if they attend an accredited school, college or university on a full-time basis) who depend mainly on you for support and maintenance; (2) natural, adopted, foster and stepchildren who live with you; (3) children not living with you for whom a court requires you to provide insurance, and (4) children incapable of self-sustaining employment by reason of mental retardation or physical handicap and who became so incapable prior to age 19 while covered under this Group Policy.

THE PROTECTOR

Travel Accidental Death and Dismemberment Insurance

TERMS AND CONDITIONS

Coverage is provided to you, the Insured, and any Covered Dependents, subject to all the exclusions and provisions of the Group Policy. This Certificate is a description of the coverage provided under the Group Policy. In this Certificate, the "Insured" may be referred to as "you", "your", or "yours" and the insured family members may be referred to as "Covered Dependents", "Insured" or "Insureds". The Company will be referred to as "we", "our" or "us."

WHO IS COVERED

Individual Coverage: You are covered under the Group Policy.

Family Coverage: You and your Covered Dependents are covered under the Group Policy.

Covered Dependents include:

- "Dependent Spouse": Your legal spouse, unless already insured under the Group Policy as an Insured Member, and

- "Dependent Children": Your unmarried, dependent children, unless they are already insured under the Group Policy as Covered Dependents. Dependent Children include (I) children under age 19 (23 if they attend an accredited school, college or university on a full-time basis) who depend mainly on you for support and maintenance; (2) natural, adopted, foster and stepchildren who live with you; (3) children not living with you for whom a court requires you to provide insurance, and (4) children incapable of self-sustaining employment by reason of mental retardation or physical handicap and who became so incapable prior to age 19 while covered under this Group Policy.

Coverage for all Insured's who enroll and submit application and payment via US Mail, begins at 12:01 A.M. Eastern Time on the Effective Date shown on the Certificate of Insurance.

Coverage for all Insured's who enroll via AAA.com, begins at the Effective Date and Time reflected on the Confirmation Page of the on-line enrollment process and reflected on the Certificate of Insurance.

CONTINUATION OF COVERAGE

The term of this Certificate is one (1) year from the effective date. You may renew coverage for additional one-year periods upon timely payment of the premium due, unless terminated as provided below.

WHEN COVERAGE ENDS

Coverage will automatically terminate without notice to the Insureds on the earliest of the following dates:

- Any premium due date, unless payment is received by the Company within 31 days after that premium due date.

- The first renewal date of this Certificate of Insurance following the date the Group Policy terminates.

- The first renewal date of this Certificate following the date of termination of your membership in the AAA Club shown on the Certificate of Insurance.

- For Covered Dependents, in addition to the above, coverage will terminate when they no longer qualify as Covered Dependents.

If the coverage under this Certificate of Insurance is terminated for any reason and you re-enroll or reinstate the insurance with lapse, any loss an Insured suffers during the lapse will not be covered. Lapse is the time period between the end of the terminated coverage and the beginning of the re-enrolled or reinstated coverage.

DEFINITION OF ACCIDENTAL BODILY INJURIES/ACCIDENTAL DEATH AND ACCIDENTAL DISMEMBERMENT INJURIES

- Accidental Bodily Injuries as used in this Certificate of Insurance means bodily injury sustained as a result of a Covered Travel Accident that occurs while coverage is in force as to the Insured. The injury must result directly from that accident and independently of all other causes.

- Accidental Death means death which results directly from an Accidental Bodily Injury and independently of all other causes and is not caused by or contributed to by sickness or disease.

- Accidental Dismemberment as used in this Certificate of Insurance means dismemberment resulting directly from an Accidental Bodily injury and independently of all other causes. "Covered Loss" with reference to limbs means complete severance through or above the wrist or ankle joint and does not mean loss of use, whether partial or total, of the limb. With reference to eye or eyes, "Covered Loss" means the irrecoverable loss of entire sight.

- Scheduled Airline Accident means an Accidental Death or Accidental Dismemberment from an Accidental Bodily Injury to an Insured as a result of a collision, wrecking, or explosion of a scheduled airline in which the Insured is a fare-paying passenger and not as a pilot or crew member, and one in which the Insured is riding in an aircraft operated on a regularly scheduled flight by:

- a scheduled airline of United States registry holding a Certificate of Public Convenience and Necessity issued by the U.S. Department of Transportation,

- a scheduled airline of foreign registry holding a certificate, license or similar authorization for scheduled air transportation by the governmental authorities having jurisdiction for civil aviation in the country of registry,

- a transport type aircraft operated by the Military Airlift Command of the United States or

- a supplemental air carrier of United States registry, authorized to operate as such, under a certificate issued by the U.S. Department of Transportation.

- Common Carrier Accident means Accidental Death or Accidental Dismemberment from an Accidental Bodily Injury to an Insured as a result of a collision, wrecking, or explosion of a Common Carrier in which the Insured is a fare-paying passenger. Such collision, wrecking or explosion must cause visible damage to the Common Carrier and leave it in a different condition than before the accident. A Common Carrier, as used in this Certificate of Insurance, means any land or water vehicle owned and operated by a business duly licensed to carry passengers for hire.

- Land Motor Vehicle Accident means Accidental Death or Accidental Dismemberment from an Accidental Bodily Injury to an Insured as a result of: (1) a collision, wrecking, or explosion of a Land Motor Vehicle in which the Insured is riding or driving that causes visible damage to the Land Motor Vehicle and leaves it in a different condition than before the accident. A Land Motor Vehicle means and includes a four- wheel private passenger automobile, a station wagon, a motor home or camper, a non-military jeep, and a truck with a load capacity of 2,000 pounds or less. A Land Motor Vehicle does not mean and excludes a motorcycle, moped, motorized scooter, tractor, a vehicle for hire driven by an Insured paid to drive the vehicle, taxi or other public transportation, any non-motorized vehicle, and any vehicle not principally designed and licensed for travel on public roads.

- Pedestrian Accident means Accidental Death or Accidental Dismemberment from an Accidental Bodily Injury sustained as a result of being struck by any motor vehicle while traveling on foot on a publicly owned street, sidewalk, road, or highway.

When an Insured suffers any of the following Covered Losses as a result of Injuries, as these terms are defined, the Company will pay the benefit amount shown. Only one benefit amount will be paid for any one accident.

| If "INDIVIDUAL" coverage is selected | ||

| Covered Losses | Scheduled Airline Benefits | Common Carrier, Land Motor Vehicle & Pedestrian Benefits |

| Life | Maximum Benefit | ½ of Maximum Benefit |

| Two limbs or both eyes | Maximum Benefit | ½ of Maximum Benefit |

| One limb and one eye | Maximum Benefit | ½ of Maximum Benefit |

| One limb or one eye | Maximum Benefit | ½ of Maximum Benefit |

| If "FAMILY" coverage is selected | ||

| (a) Payments for the Insured: | ||

| Covered Losses | Scheduled Airline Benefits | Common Carrier, Land Motor Vehicle & Pedestrian Benefits |

| Life | Maximum Benefit | ½ of Maximum Benefit |

| Two limbs or both eyes | Maximum Benefit | ½ of Maximum Benefit |

| One limb and one eye | Maximum Benefit | ½ of Maximum Benefit |

| One limb or one eye | Maximum Benefit | ½ of Maximum Benefit |

(b) Payments for the Covered Dependent Spouse:

If, on the date of the accident, the Insured:

- Has no Covered Dependent Children, the benefits for the Covered Dependent Spouse will be fifty percent (50%) of the amount available to the Insured, OR

- The Insured has Covered Dependent Children, the benefits for the Insured's Covered Dependent Spouse will be forty percent (40%) of the amount available to the Insured.

If, on the date of the accident, the Insured:

- Does not have a Covered Dependent Spouse, the benefit for each of the Insured's Covered Dependent Children will be twenty percent (20%) of the amount available to the Insured, OR

- Has a Covered Dependent Spouse, the benefit for each of the Insured's Covered Dependent Children will be five percent (5%) of the amount available to the Insured.

FOR LAND MOTOR VEHICLE & PEDESTRIAN BENEFITS ONLY, the benefit amount the Insured is entitled to receive under the terms and provisions of the Policy is automatically reduced by fifty percent when an Insured reaches the age of 75 and reduced by seventy-five percent when an Insured reaches the age of 80. Reduction of the benefits of an Insured will not reduce the benefits of other Insureds covered under this Certificate of Insurance who have not reached the ages for their reduction of benefits.

EXPOSURE AND DISAPPEARANCE DUE TO TRAVEL ACCIDENTS

If, while insured under the Group Policy, an Insured is unavoidably exposed to the elements because of an accident resulting in the disappearance, sinking or damaging of an air conveyance in which he was riding, and if as a result of such exposure the Insured suffers a loss, as defined above, such loss will be covered under the Group Policy.

If, while insured under the Group Policy, an Insured disappears because of an accident resulting in the disappearance or sinking of an air conveyance in which he was riding, and if the body of the Insured has been found within fifty-two weeks after the date of such accident, it will be presumed that he suffered loss of life as a result of injuries covered by the Group Policy.

EXCLUSIONS

Benefits will not be payable if death, dismemberment or bodily injury to you or a Covered Dependent is caused by any of the following:

- Suicide or self-destruction or an attempt thereat while sane or insane;

- Participation in a riot, a declared or undeclared war or any maneuvers or training exercise of an armed service;

- Commission of, or attempting to commit any crime;

- The voluntary taking of any drug or acting under the influence or effect of that drug (unless prescribed or administered by a Doctor and taken in accordance with given instructions);

- Disease, bodily infirmity or sickness of any kind, unless a direct result of an accidental injury;

- Losses which are the result of an accident that occurred while an Insured is operating a land motor vehicle or is a pedestrian and has a blood alcohol level of .08 percent weight per volume or higher.

- NOTICE OF CLAIM. Notice of claim must be given to the Company within twenty (20) days after the occurrence or commencement of any loss covered by this Group Policy, or as soon thereafter as reasonably possible. Notice given by or on behalf of the Insured or the Designated Beneficiary to the Company or to any authorized agent of the Company, with information sufficient to identify the Insured, shall be deemed notice to the Company.

- CLAIM FORMS AND PROOF OF LOSS. The Company, upon receipt of a notice of claim, will promptly send the Insured or Designated Beneficiary the forms required for filing a Proof of Loss for the claim. Proofs of Loss must be in writing and must include the name of the Insured, a description of the occurrence and the character and extent of the loss for which the claim is made. The written proof of loss must be received by the Company within ninety (90) days after the date of the loss for which claim is made. Failure to furnish such proof within the time required shall not invalidate or reduce any claim if it was not reasonably possible to give proof within such time, provided such proof is given as soon as reasonably possible and in no event, except in the absence of legal capacity, later than one year from the time proof is otherwise required.

- TIME OF PAYMENT OF CLAIMS. All payments for claims under the Group Policy will be made promptly upon receipt of completed written proof of the loss, but in no event more than sixty (60) days after receipt of such proof.

- PAYMENT OF CLAIMS. Payment for loss of life will be made to the Designated Beneficiary in effect at the time of payment and in accordance with the terms of this Group Policy. If no such designation is then effective, payment for loss of life of the Insured shall be made as follows:

- to the spouse of the Insured, or

- equally to the then living lawful children of the Insured, including stepchildren and adopted children, if any, or

- equally to the Insured's parents or parent then living, or

- to the estate of the Insured. Any other claims that remain unpaid at the Insured's death may, at the option of the Company, be paid either to the Insured's legal beneficiary or to the Insured's estate. All other claims will be paid to the Insured.

- CHANGE OF BENEFICIARY. The Insured Member may change the Designated Beneficiary at any time, and the consent of the beneficiary is not required for any change of beneficiary. The Insured Member may change the beneficiary designation by written notice to the Company in satisfactory form. Any such change shall take effect as of the date the notice was signed, whether or not the Insured Member is living when the change is recorded, subject to any payment made by the Company before such recording.

- OTHER INSURANCE UNDER THIS GROUP POLICY. No Insured may have in force at any time more than one Certificate of Insurance under the Group Policy. In case of any duplication, only one Certificate (which shall be elected by the Insured, his Designated Beneficiary or his estate) shall be valid and the excess insurance will be void. All premiums paid for such excess insurance will be returned.

- EFFECTIVE TIME. The effective time for any dates used shall be 12:01 A.M. Eastern Time.

- PHYSICAL EXAMINATIONS AND AUTOPSY. The Company, at its own expense, shall have the right and opportunity to examine the person of anyone covered under the Group Policy when and as often as it may reasonably require during the investigation of a claim under the Group Policy and to make an autopsy in case of death where it is not forbidden by law.

- LEGAL ACTIONS. No action, at law or in equity, shall be brought to recover on the Group Policy prior to the expiration of ninety (90) days after written proof of loss has been given to the Company in accordance with the requirements of the Group Policy. No such action shall be brought after the expiration of three (3) years after the time written proof of loss is required to be given to the Company.

- CONFORMITY WITH STATE STATUTES. Any provision of the Group Policy, which, on its effective date, is in conflict with the statutes of the state in which the Policyholder is located on such date, is hereby amended to conform to the minimum requirements of such statutes.

- CERTIFICATE OF INSURANCE. A Certificate of Insurance will be issued to each Insured Member. The rights and limitations described in the Certificate are controlled by the provisions of the Group Policy and are subject to any changes in the Group Policy. The Company reserves the right to terminate or change the Group Policy without the consent of the Insured Member. The Company shall have the Group Policy available for inspection by Insured Members at all reasonable times.

Spencer M. Roman

Executive Vice President

And Chief Operating Officer

Paul Laskow

Vice President, Secretary

And General Counsel

Underwritten by:

KEYSTONE INSURANCE COMPANY

Wilmington, Delaware

Administrative Office:

PO Box 508

Voorhees, NJ 08043

1-800-763-2100